Three years into my finance career, I was making $30k less than my college roommate who started at the same time. Turns out, I’d made some classic rookie mistakes that nobody warned me about.

The financial analysis profession offers compelling earning potential, with the median annual wage for financial and investment analysts reaching $101,350 in May 2024 according to the Bureau of Labor Statistics. But here’s what those median figures don’t tell you – the actual earning potential can be dramatically different depending on choices you make early in your career.

I wish someone had given me the real story about what you can actually earn in this field. The numbers in job postings? They barely scratch the surface.

Table of Contents

-

What Financial Analysts Actually Make (Spoiler: It’s Complicated)

-

Geographic Pay Gaps That’ll Blow Your Mind

-

Industry Sectors That Pay the Most (And Which Ones Don’t)

-

Skills That Can Add $20K+ to Your Paycheck

-

Certifications Worth Your Time (And Money)

-

Career Moves That Actually Work

-

How to Negotiate Like You Mean It

-

Where the Money’s Heading Next

-

Protecting Your Career Credentials

TL;DR

-

Entry-level analysts earn $55K-$75K, but senior specialists can hit $160K+ with the right moves

-

NYC pays 20-30% above national averages, but secondary markets offer better bang for your buck

-

Investment banking starts at $100K-$150K base but demands your soul in return

-

Learn Python, R, and advanced Excel – they’re worth $10K-$20K annually

-

CFA certification can boost your earning potential by 20-50%

-

ESG and crypto analysis are paying premium rates for specialized knowledge

-

Job-hopping every 2-3 years often means 30-50% salary jumps

What Financial Analysts Actually Make (Spoiler: It’s Complicated)

Starting Out: Reality vs. Expectations

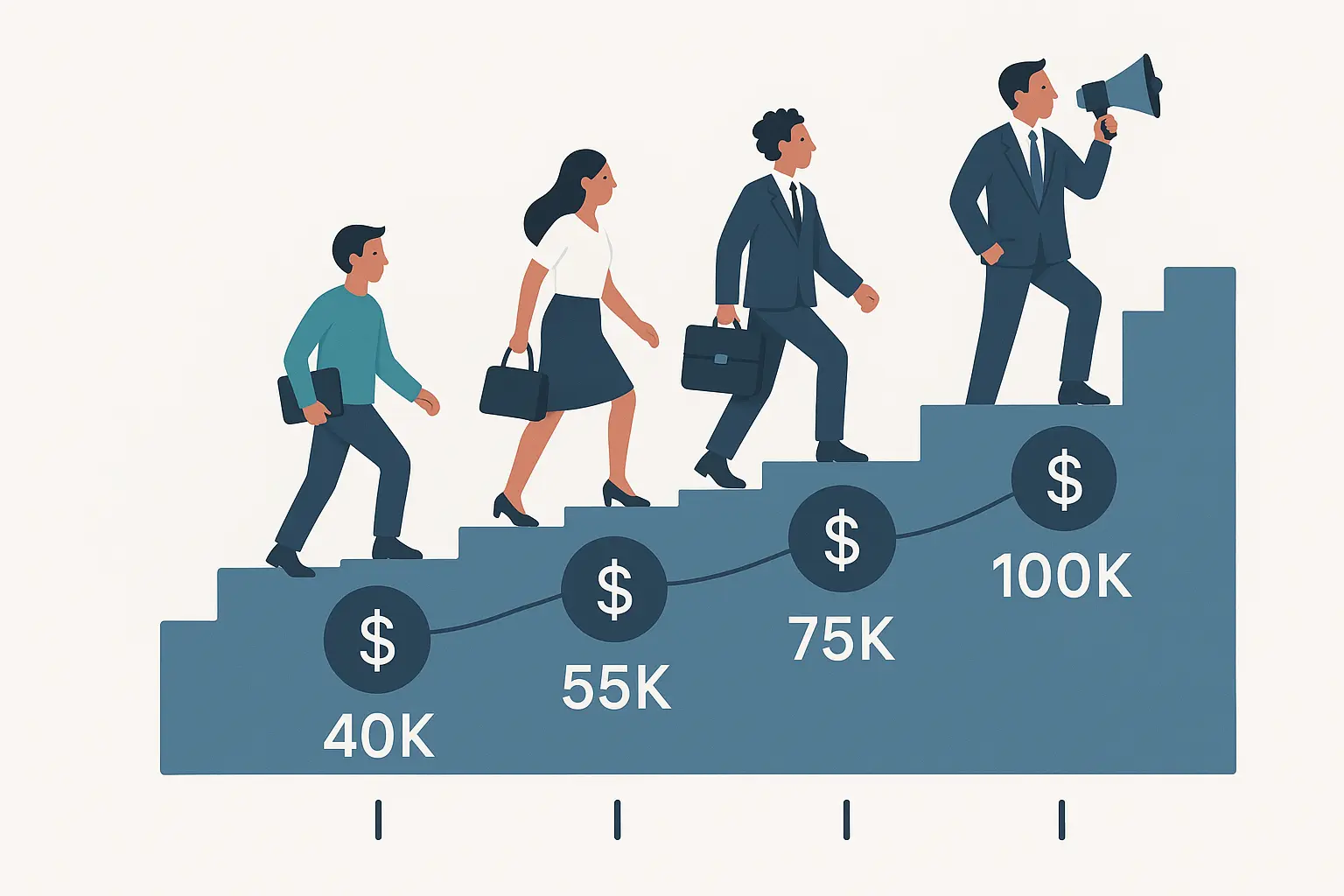

Fresh out of college, you’re looking at $55,000-$75,000 to start. But here’s what I didn’t understand then – that base number is just the beginning of the story.

Your total package includes health benefits, 401k matching, and performance bonuses that can add another 10-20% annually. Many firms throw in professional development budgets and continuing education support, which becomes incredibly valuable as you climb the ladder.

The biggest mistake I made? Not negotiating my starting salary properly. I was so excited to get an offer that I said yes immediately. Don’t be me – that initial number sets the foundation for everything that comes after.

Mid-Career: Where Things Get Interesting

After proving yourself for 3-5 years, the game changes completely. Mid-level analysts command $75,000-$110,000 in base salary, but the real money is in enhanced bonus structures reaching 25-40% of your annual pay.

This is when stock options and profit-sharing start appearing in your package. I’ve seen analysts at growing firms double their total compensation just from equity appreciation during strong market periods.

The jump from entry-level to mid-career represents one of the most dramatic increases you’ll see. I watched a colleague go from $65k to $125k total compensation in three years through smart positioning and skill development.

|

Experience Level |

Base Salary Range |

Bonus Potential |

Total Compensation |

|---|---|---|---|

|

Entry-Level (0-2 years) |

$55,000-$75,000 |

5-15% |

$58,000-$86,000 |

|

Mid-Career (3-5 years) |

$75,000-$110,000 |

25-40% |

$94,000-$154,000 |

|

Senior Level (5+ years) |

$110,000-$160,000 |

30-50% |

$143,000-$240,000 |

Senior Level: Where Specialization Pays Off

Senior analysts and specialists enter a completely different compensation tier. Base salaries range from $110,000-$160,000, but specialized expertise can push these numbers much higher.

I know senior analysts in niche areas who earn more than some VPs because their expertise is irreplaceable. Market conditions, industry specialization, and leadership responsibilities all factor into your final package.

Overall employment of financial analysts is projected to grow 6 percent from 2024 to 2034, faster than the average for all occupations, which means strong job security and continued demand for experienced professionals.

Geographic Pay Gaps That’ll Blow Your Mind

Major Financial Centers: Premium Pay, Premium Costs

New York City sets the gold standard, with average salaries running 20-30% above national averages. San Francisco, Chicago, and Boston follow closely, often including cost-of-living adjustments and housing assistance.

These premium markets justify higher salaries through increased living costs, but they also offer unmatched networking opportunities and career acceleration. The trade-off between higher pay and higher expenses requires serious consideration of your long-term goals.

According to industry data, the mean salary for a financial analyst in New York is about $137,000, considerably higher than the national median income for financial analysts, which is only about $86,000.

Secondary Markets: Hidden Gems

Charlotte, Dallas, and Denver present compelling alternatives with salaries typically 10-15% below major centers but dramatically lower living costs. Your dollar stretches further, and you often get better work-life balance without sacrificing career growth.

Remote work has increasingly bridged these geographic gaps. Many analysts now enjoy major-market salaries while living in lower-cost areas, creating the best of both worlds.

Take Sarah, who moved from NYC (earning $125,000) to Austin (earning $105,000). Her salary dropped $20,000, but her cost of living dropped $35,000 annually. Net result? $15,000 more in her pocket plus a much better quality of life.

International Opportunities Worth Considering

Global financial centers like London, Hong Kong, and Singapore actively recruit experienced analysts with packages that often exceed domestic opportunities. These roles frequently include relocation assistance, tax equalization, and international experience premiums.

Working internationally accelerates career development through exposure to different markets, regulations, and business practices. The compensation reflects this added value, making international assignments attractive stepping stones for ambitious analysts.

Industry Sectors That Pay the Most (And Which Ones Don’t)

Investment Banking: High Risk, High Reward

Investment banking consistently offers the highest starting salaries in financial analysis. First-year analysts earn $100,000-$150,000 base plus substantial bonuses that can double your total compensation during strong market years.

The demanding work environment and notorious long hours are offset by accelerated career progression and exceptional earning potential. Many analysts use investment banking as a launching pad for lucrative careers in private equity, hedge funds, or corporate development.

I won’t sugarcoat it – investment banking will test your limits. But the financial rewards and career acceleration can be worth the sacrifice if you’re willing to put in the work.

Corporate Finance: Balance and Growth

Corporate finance positions offer more sustainable work-life balance with competitive salaries ranging from $70,000-$120,000 for analysts. These roles provide broader business exposure and diverse career paths within organizations.

You’ll work closely with different departments, gaining valuable insights into operations, strategy, and decision-making processes. This broad exposure often leads to leadership opportunities and executive tracks that pure investment roles don’t offer.

|

Industry Sector |

Starting Salary |

Mid-Career Salary |

Work-Life Balance |

Career Growth |

|---|---|---|---|---|

|

Investment Banking |

$100K-$150K |

$200K-$400K |

Poor |

Excellent |

|

Corporate Finance |

$70K-$120K |

$120K-$180K |

Good |

Good |

|

Asset Management |

$80K-$130K |

$150K-$250K |

Fair |

Very Good |

|

Insurance |

$60K-$90K |

$100K-$140K |

Excellent |

Good |

|

Government/Non-Profit |

$50K-$75K |

$80K-$120K |

Excellent |

Limited |

Specialized Finance Roles

Risk management, compliance, and financial planning & analysis roles each offer unique compensation structures. These specialized positions often command premium pay due to specific expertise requirements and regulatory importance.

Compliance analysts, for example, are increasingly valuable as regulatory requirements expand. Their specialized knowledge makes them indispensable, often resulting in compensation packages that exceed traditional analyst roles.

Skills That Can Add $20K+ to Your Paycheck

Technical Skills That Actually Matter

Advanced Excel proficiency and VBA programming can increase your salary potential by 15-25%. Analysts who build comprehensive DCF models, LBO analyses, and sensitivity analyses are particularly valued in today’s data-driven environment.

Financial modeling expertise sets you apart from peers and opens doors to specialized roles. Investment banks and private equity firms specifically seek analysts who can construct complex models that support million-dollar investment decisions.

Skills That Actually Move the Needle:

-

Advanced Excel functions (INDEX/MATCH, array formulas, pivot tables)

-

VBA programming for automation

-

DCF modeling proficiency

-

LBO analysis capabilities

-

Sensitivity and scenario analysis

-

Monte Carlo simulations

-

Financial statement modeling

-

Valuation methodologies

Programming Skills That Pay

Python, R, SQL, and data visualization tools like Tableau or Power BI have become increasingly valuable. These skills can add $10,000-$20,000 to your annual compensation and qualify you for quantitative analyst roles.

Programming skills bridge the gap between traditional finance and modern data science. Analysts who can automate processes, analyze large datasets, and create compelling visualizations become indispensable team members.

According to recent analysis, the average salary for a Financial Analyst with 7+ years of experience is $150,000, while the average salary for those with less than 1 year of experience is $79,500, highlighting the significant impact that skill development and experience have on compensation growth.

Emerging Technology Skills

Machine learning, blockchain analysis, and AI applications in finance represent the next frontier of valuable skills. Early adopters of these technologies often command significant salary premiums as firms scramble to build these capabilities.

Michael, a traditional analyst, invested six months learning Python and machine learning techniques. This skill upgrade allowed him to transition from an $85,000 analyst role to a $115,000 quantitative analyst position – a 35% salary increase purely through technical skill development.

Certifications Worth Your Time (And Money)

CFA Charter: The Gold Standard

The Chartered Financial Analyst designation remains the gold standard in our industry. CFA charterholders typically see earning potential increase by 20-50% depending on their experience level and role.

Beyond immediate salary impact, the CFA charter qualifies you for senior positions and specialized roles that aren’t available to non-charterholders. The rigorous curriculum and ethical standards create a professional distinction that employers recognize and compensate accordingly.

Recent data from “SmartAsset” shows that as of March 2025, the average CFA salary ranges significantly across platforms, with ZipRecruiter reporting $100,458 per year and Glassdoor showing a median of $162,000 annually, demonstrating the premium compensation that CFA designation commands.

Other High-Value Certifications

Financial Risk Manager (FRM), Certified Public Accountant (CPA), and Financial Modeling & Valuation Analyst (FMVA) certifications each provide specialized knowledge that commands premium compensation.

Certification Priority List:

-

CFA Charter – 20-50% salary increase potential

-

FRM Certification – Risk management premium

-

CPA License – Accounting and compliance roles

-

FMVA Certification – Modeling expertise validation

-

Series 7/63 – Securities industry requirements

-

PMP Certification – Project management capabilities

Niche Certifications for Specialized Markets

ESG analysis, cryptocurrency, and alternative investment certifications are becoming increasingly valuable as these sectors expand. Limited expertise and high demand create opportunities for significant salary premiums.

Getting certified in emerging areas positions you ahead of market demand. Early movers

Getting certified in emerging areas positions you ahead of market demand. Early movers in these specializations often become subject matter experts within their organizations, leading to consulting opportunities and executive roles.

Career Moves That Actually Work

Strategic Progression Timeline

Most analysts advance to associate roles within 2-3 years, typically seeing 30-50% salary increases with this progression. Success requires demonstrated analytical skills, client relationship capabilities, and emerging leadership potential.

Realistic Career Timeline:

-

Years 0-2: Junior Analyst – Focus on technical skills and learning

-

Years 2-4: Analyst – Develop specialization and client relationships

-

Years 4-7: Senior Analyst – Lead projects and mentor juniors

-

Years 7-10: Associate/VP – Strategic responsibilities and team management

-

Years 10+: Director/MD – Business development and P&L ownership

Building Specialized Expertise

Developing niche expertise in areas like ESG analysis, cryptocurrency, or emerging markets commands premium compensation. Specialists often earn 20-40% more than generalist analysts due to their focused knowledge and limited competition.

Jennifer transitioned from general equity research to ESG analysis specialization in 2022. Her focused expertise in sustainable investing allowed her to command a $25,000 salary premium over her generalist peers, moving from $95,000 to $120,000 within 18 months.

Advanced Education Impact

MBA degrees from top-tier schools can accelerate career progression and increase earning potential by $50,000-$100,000 annually. Many employers offer tuition reimbursement programs, making advanced education more accessible.

The network and credibility that come with prestigious MBA programs often matter as much as the education itself. Alumni connections frequently lead to job opportunities and career advancement that justify the investment.

How to Negotiate Like You Mean It

Research and Preparation That Works

Look, I used to wing salary negotiations and got burned every time. Now I spend weeks preparing, and it shows in my paychecks. Start with Glassdoor and PayScale, but don’t stop there – hit up Robert Half’s salary guides and talk to people actually doing the job.

Here’s what changed everything for me: I started keeping a “wins folder” throughout the year. Every time I saved the company money, landed a big client, or caught an error that could’ve been costly, I documented it with numbers. When negotiation time came, I wasn’t scrambling to remember what I’d accomplished.

My Go-To Prep Checklist:

-

Check 3+ salary sources (don’t rely on just one)

-

Write down your biggest wins from the past year

-

Find out what your company’s been paying new hires

-

Practice your pitch out loud (seriously, do this)

-

Know your walk-away number before you sit down

Timing Your Negotiation

Timing isn’t just about performance review season anymore. I’ve had my biggest wins negotiating right after completing major projects or when the company just announced strong quarterly results. They’re feeling good about spending money, and your value is crystal clear.

The worst time? When layoffs are happening or budgets are frozen. Read the room – if your boss is stressed about cuts, maybe wait a few months.

Recent analysis from “Dice” highlights that data analysts with specialized skills can command significantly higher salaries, with the field showing strong growth potential as companies increasingly rely on data-driven decision making.

Beyond Base Salary Considerations

This is where I wish someone had coached me earlier . I used to focus only on base salary and missed out on thousands in total value. That signing bonus? Negotiate it. Extra vacation days? They’re worth more than you think. Professional development budget? That’s your ticket to skills that’ll pay off for years.

My friend Sarah negotiated remote work flexibility instead of a $5k raise. She calculated she saves $8k annually on commuting and work clothes, plus gets back 10 hours a week. Sometimes the non-cash stuff is worth way more.

Where the Money’s Heading Next

Technology’s Impact on Analyst Roles

Here’s the thing about AI and automation – everyone’s panicking about robots taking our jobs, but I’m seeing the opposite. The mundane data entry stuff? Yeah, that’s going away. But the strategic thinking, the “what does this actually mean for the business” part? That’s where the money is now.

I’ve watched colleagues who embraced Python and machine learning jump salary brackets while others who resisted got stuck doing increasingly basic work. The choice is pretty clear.

ESG and Sustainable Finance Growth

ESG isn’t just trendy anymore – it’s where serious money is flowing. I know analysts who pivoted to ESG work and saw immediate $20-30k bumps in their offers. Companies are desperate for people who understand both traditional finance and sustainability metrics.

The learning curve isn’t as steep as you’d think. Most of it builds on fundamental analysis skills you already have, just with different data points.

Cryptocurrency and Digital Assets

This space is wild, but the paychecks reflect that chaos. Digital asset analysts I know are pulling down 40-50% more than traditional roles, but you’ve got to stomach the volatility – both in the markets and job security.

If you’re risk-tolerant and can learn fast, crypto firms are throwing money at anyone with solid analytical foundations and willingness to dive deep into blockchain tech.

Protecting Your Career Credentials

Your degrees and certifications aren’t just pieces of paper – they’re career insurance. I learned this when my MBA diploma got destroyed in a basement flood right before a job interview where they wanted to verify my education.

Understanding the true value of your educational credentials becomes crucial when negotiating these entry-level positions, especially when considering whether your college degree investment will pay off in the competitive financial analysis field.

When pursuing advanced certifications like the CFA, maintaining proper documentation becomes crucial for career advancement, which is why many professionals consider professional diploma display options to showcase their achievements in their offices.

As you develop these advanced skills, protecting your educational credentials becomes essential for career mobility, especially when considering replacement options for lost diplomas that validate your qualifications during job transitions.

For professionals pursuing advanced degrees, understanding the true cost of a college degree becomes essential when weighing MBA investment decisions.

Keep digital copies of everything, but also consider professional backup services for your most important credentials. When you’re earning six figures because of that CFA or specialized certification, protecting those documents just makes sense.

Store originals safely and have quality copies available for interviews, office displays, or verification processes. Understanding how to display certificates on wall professionally can enhance your credibility with clients and colleagues. Additionally, for those considering academic transcript backup copies, it’s a small investment that prevents major headaches down the road.

Final Thoughts

Your salary story doesn’t have to follow anyone else’s script. I’ve seen people double their income in three years through smart moves, and I’ve watched others plateau because they played it too safe.

The finance world rewards people who stay curious, adapt quickly, and aren’t afraid to bet on themselves. Whether that means learning Python, getting your CFA, or jumping to a hot sector like ESG – the opportunities are there if you’re willing to reach for them.

Stop thinking about salary as something that happens to you. It’s something you actively build through the choices you make, the skills you develop, and the value you create. The analysts making the big money aren’t necessarily the smartest ones – they’re the ones who understood this game early and played it strategically.

Remember that salary is just one component of your total career satisfaction. The best financial analyst roles combine competitive compensation with professional growth, work-life balance, and meaningful work that leverages your analytical skills to drive important business decisions.

Your next salary bump is probably one smart decision away. The question is: what’s that decision going to be?