The actuarial profession is experiencing unprecedented growth, with employment projected to grow 22 percent from 2023 to 2033, much faster than the average for all occupations. This explosive demand creates unique salary opportunities that most career guides completely miss. While traditional advice focuses on passing exams and climbing corporate ladders, the real money game involves understanding market forces, strategic timing, and leveraging your analytical skills to hack your own compensation.

Table of Contents

- The Real Actuarial Money Game: Market Forces You Haven’t Heard About

- Strategic Career Moves That Actually Boost Your Paycheck

- Using Your Analytical Skills to Hack Your Own Compensation

- The Future of Actuarial Pay: New Opportunities Beyond Insurance

TL;DR

- Each actuarial exam you pass is worth serious money, but timing your job switches around exam completion can boost your salary by 30-50%

- Remote work has completely changed the salary game – you can now earn big city money while living anywhere

- Emerging specialties like climate risk and cyber insurance pay 15-30% more than traditional roles

- Your total compensation package often includes hidden value worth 20-40% of your base salary

- Strategic job hopping every 3-4 years during your first decade typically results in 30-50% higher earnings

- AI-savvy actuaries are seeing 10-25% salary bumps while tech-resistant ones face stagnating pay

- Building quantifiable performance metrics gives you concrete data to justify raises

- Non-traditional employers like tech companies often pay 25-40% more than insurance companies

The Real Actuarial Money Game: Market Forces You Haven’t Heard About

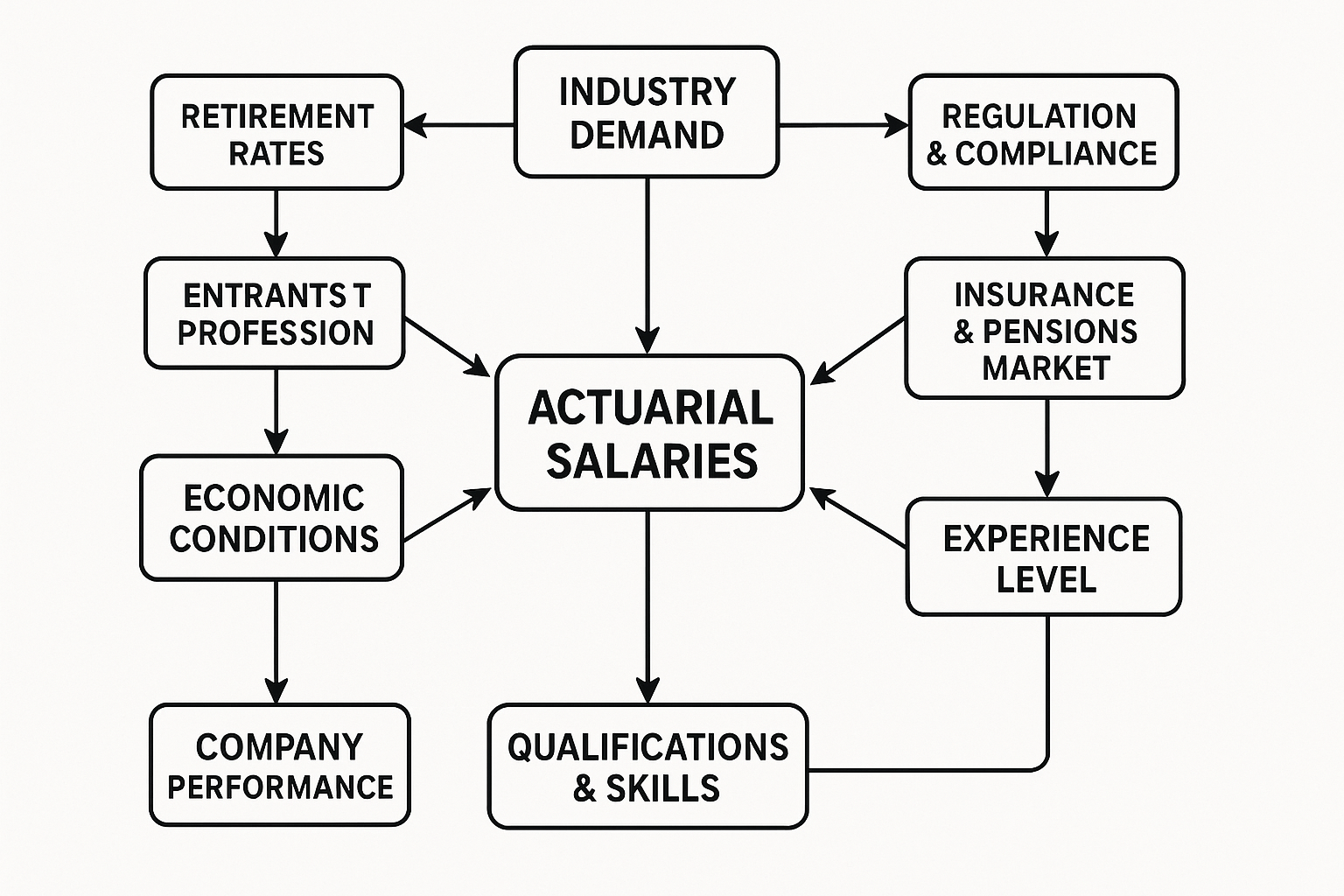

Most salary discussions focus on basic numbers, but I’ve discovered the actuarial profession operates in a complex ecosystem where your pay gets influenced by regulatory changes, tech disruption, and evolving risk landscapes. These forces create unique salary dynamics that traditional career guides completely miss, and understanding them can dramatically impact your earning potential.

The actuarial salary landscape isn’t just about your exam progress or years of experience. Market forces shape compensation in ways that most actuaries never consider. When I started tracking these patterns, I realized that successful actuaries treat their careers strategically, timing moves around regulatory shifts and industry disruptions.

Your Exam Progress Is Actually a Strategic Investment Portfolio

Every actuarial exam you pass represents a significant salary milestone, but here’s what’s interesting – the financial impact varies dramatically based on timing, employer type, and market conditions. I’ve learned this creates a strategic game of career advancement that goes way beyond simple pass/fail metrics.

Understanding the true value of your educational investments becomes crucial when considering whether pursuing advanced degrees provides sufficient return on investment, particularly as an actuary where specialized certifications often matter more than traditional degree credentials.

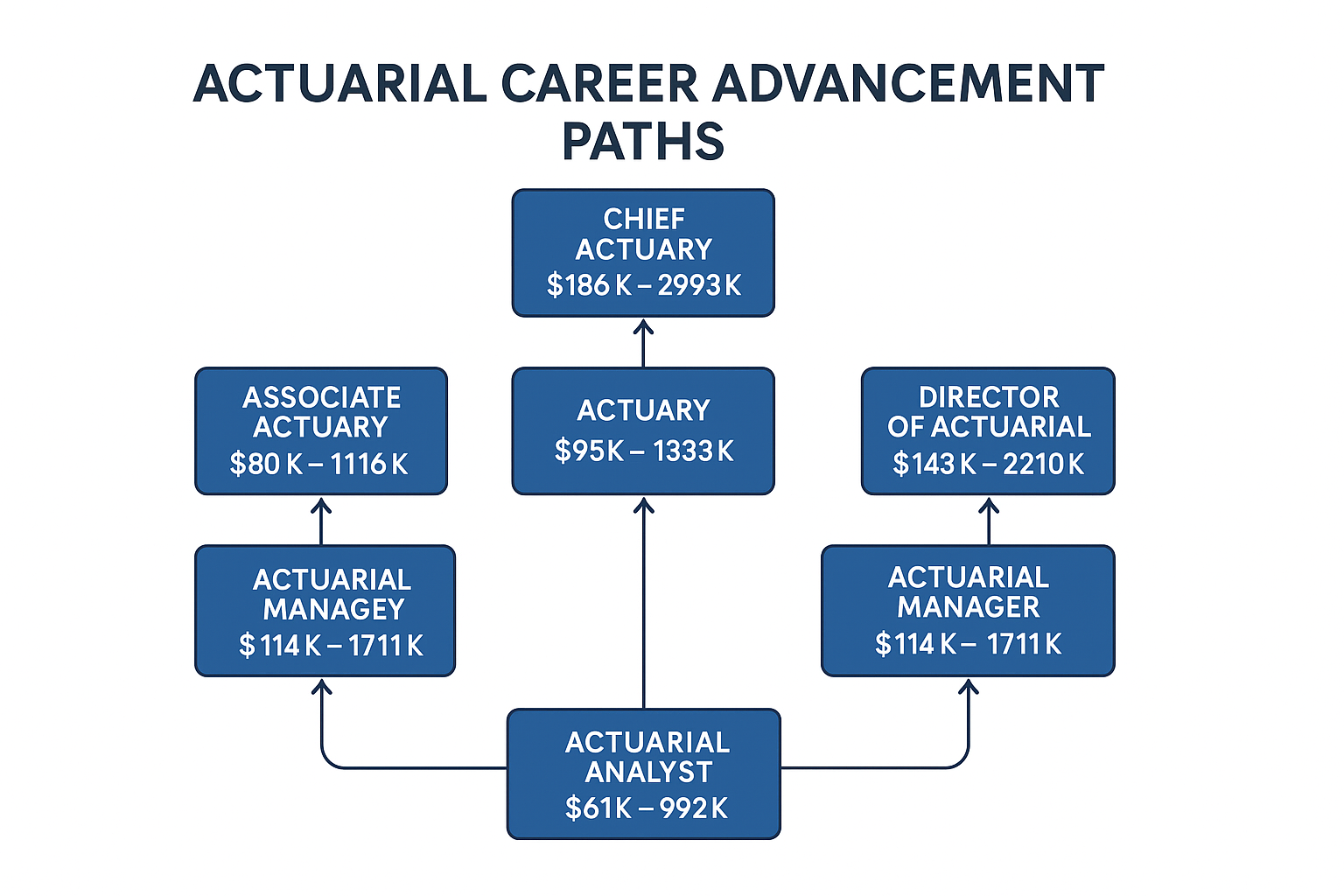

According to DW Simpson’s 2024 Actuarial Salary Survey, compensation data shows clear linear trends where total compensation increases significantly with years of experience, with bonus structures varying substantially across different career stages.

| Exam Level | Typical Salary Increase | Optimal Timing Strategy |

|---|---|---|

| ASA/ACAS | 15-25% | Switch jobs 6-12 months after passing |

| FSA/FCAS | 20-35% | Negotiate promotion before job change |

| Fellowship + Specialty | 10-20% | Focus on niche expertise development |

| Regulatory Appointments | 25-40% | Requires 5+ years experience minimum |

Why Exam Speed Matters More Than You Think

Actuaries who pass exams quickly (within 2-3 years) command higher starting salaries and faster promotion tracks. However, this velocity premium diminishes after fellowship, which suggests there are optimal timing strategies for exam completion that most people don’t consider.

Sarah, a new actuary, passed her first four exams in 18 months and leveraged this momentum to negotiate a 35% salary increase when switching from a regional insurer to a national consulting firm. Her rapid exam progress demonstrated exceptional analytical ability and work ethic, making her a premium candidate.

The actuary who completes exams rapidly signals something valuable to employers beyond technical knowledge. You’re showing discipline, time management, and intellectual capacity that translates directly into higher compensation offers.

The Geographic Money Hack That’s Changing Everything

Remote work has created salary arbitrage opportunities where actuaries can earn major metropolitan salaries while living in lower-cost areas. This has fundamentally shifted traditional location-based compensation models, and smart actuaries are taking advantage.

Remote Work Salary Arbitrage Checklist:

- Research companies with fully remote actuarial positions

- Calculate cost-of-living differences between employer location and your area

- Negotiate salary based on role value, not your location

- Ensure remote work agreement includes exam support and professional development

- Consider tax implications of working remotely for out-of-state employers

- Maintain professional network through virtual actuarial society participation

The High-Risk, High-Reward Specialty Premium

Emerging actuarial specialties like climate risk, cyber insurance, and pandemic modeling command 15-30% salary premiums over traditional life/health/property roles. The catch? These areas carry higher career volatility risks that you need to weigh carefully.

Climate risk actuaries are particularly hot right now. Insurance companies desperately need professionals who can model increasingly complex weather patterns and their financial impacts. I’ve seen actuaries with just three years of experience land six-figure roles because they developed expertise in catastrophe modeling.

The Money You’re Not Seeing in Your Offer Letter

Actuarial compensation includes numerous non-salary components that can represent 20-40% of your total compensation. I’m talking about exam bonuses, study time allowances, professional development stipends, and performance-based incentives that vary significantly by employer type.

Many actuaries overlook the importance of proper documentation during career transitions, which is why understanding how to replace lost educational credentials becomes essential when switching employers or pursuing new opportunities that require verification of your qualifications.

Recent global salary surveys reveal interesting patterns, with “actuaries ranking as the second-highest paid profession” in Taiwan’s 2024 salary survey, earning NT$212,000 monthly, highlighting the international recognition of actuarial expertise.

The actuarial salary conversation gets complicated when you factor in total compensation. Base salary tells only part of the story. Your real earning potential includes elements that many actuaries never properly evaluate or negotiate.

The Real Value of Exam Support (It’s Bigger Than You Think)

The total value of employer exam support – including fees, study materials, time off, and bonuses – can exceed $15,000 per exam. This makes exam support a crucial negotiation point that impacts your effective hourly compensation during exam years.

| Exam Support Component | Typical Value | Negotiation Priority |

|---|---|---|

| Exam Fees & Materials | $1,500-2,500 | Standard (non-negotiable) |

| Study Time (150+ hours) | $5,000-8,000 | High (affects work-life balance) |

| Pass Bonuses | $2,000-5,000 | Medium (one-time benefit) |

| Failure Support | $1,000-2,000 | Low (hope you don’t need it) |

| Professional Development | $2,000-4,000 | High (ongoing career value) |

When you calculate the hourly value of study time, you realize that generous exam support policies can effectively double your compensation during exam periods. This becomes a significant factor when comparing job offers.

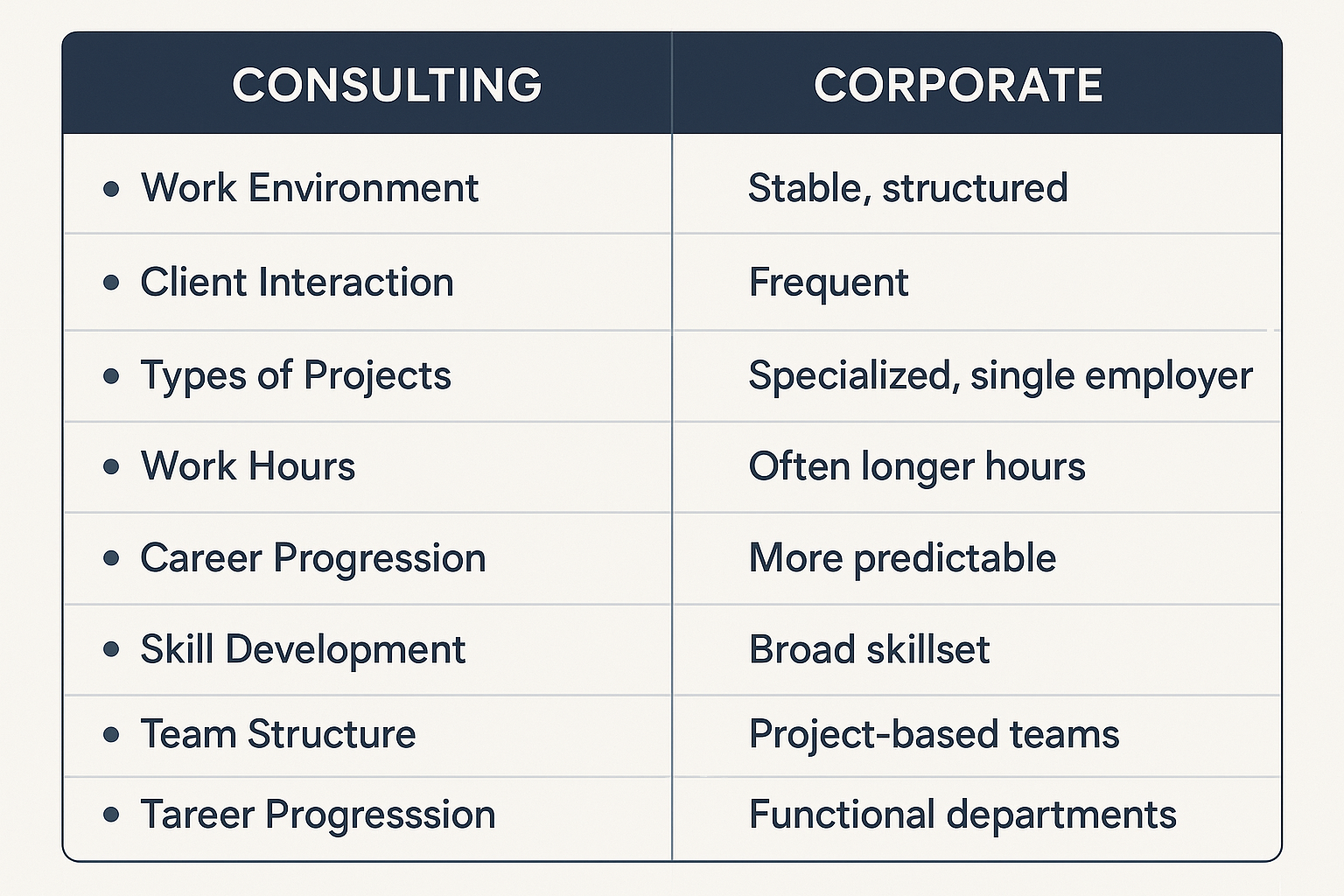

Consulting vs. Corporate: The Trade-off Nobody Explains Properly

Consulting actuaries typically earn 20-35% more in base salary but sacrifice job security and work-life balance. Corporate actuaries receive better benefits and stability but lower immediate compensation. Understanding this trade-off is crucial for long-term financial planning.

The consulting path offers faster salary growth and exposure to diverse problems, but you’ll work longer hours and face constant pressure to generate billable time. Corporate roles provide predictable schedules and comprehensive benefits, but advancement can be slower.

I’ve watched actuaries bounce between these paths throughout their careers. The key is understanding which environment matches your current life priorities and financial goals.

How Industry Disruption Is Creating Salary Chaos (And Opportunity)

The actuarial profession faces unprecedented changes from AI, InsurTech, and regulatory shifts that create both salary opportunities and risks. Traditional career paths are becoming less predictable, while new high-paying niches are emerging rapidly.

Technology is reshaping how actuaries work, and compensation reflects this disruption. Some actuaries are thriving in this environment, while others struggle to adapt. The difference often comes down to embracing change rather than resisting it.

The AI Skills Premium That’s Already Here

Actuaries who successfully integrate AI tools into their work processes are seeing 10-25% salary increases. Meanwhile, those who resist technological adaptation face stagnating compensation and reduced job security. The divide is happening now.

Michael, a senior actuary at a property & casualty insurer, taught himself Python and machine learning fundamentals. He automated several manual pricing processes, saving his company 200+ hours monthly. This initiative led to a 22% salary increase and promotion to Principal Actuary within 18 months.

The actuary who can bridge traditional actuarial science with modern data science tools becomes incredibly valuable. Companies are willing to pay premiums for professionals who can modernize their analytical processes while maintaining actuarial rigor.

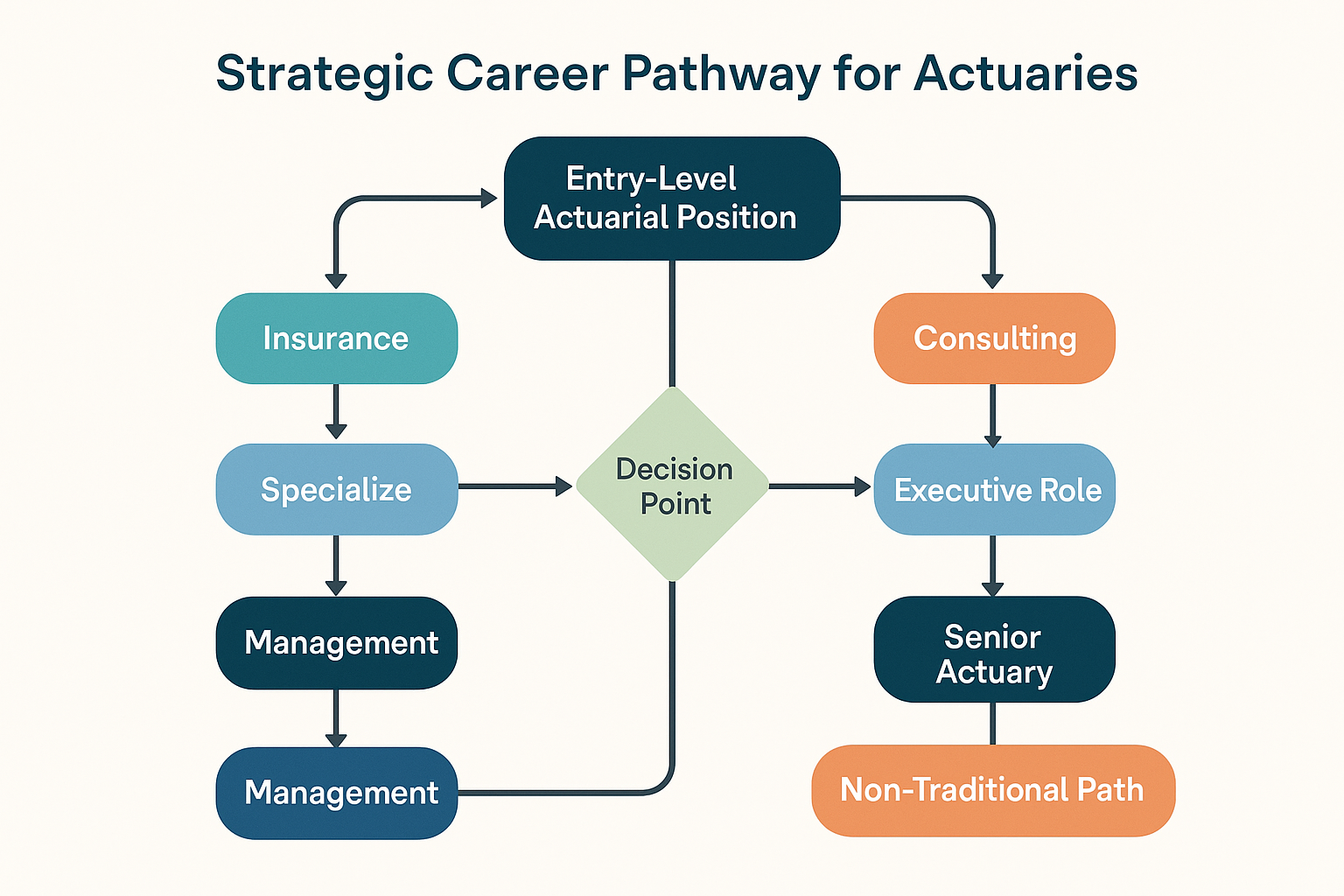

Strategic Career Moves That Actually Boost Your Paycheck

Most actuaries follow predictable salary progression patterns, but I’ve found that those who understand the strategic elements of career timing, employer transitions, and skill development can accelerate their compensation growth by 40-60% compared to passive career management.

Career strategy in the actuarial field requires more sophistication than most professionals realize. You can’t just pass exams and wait for promotions. The actuaries who earn the most money think strategically about every career move, timing transitions to maximize their market value.

The Job-Hopping Strategy That Actually Works

Actuaries who change employers every 3-4 years during their first decade typically earn 30-50% more than those who stay with single employers. But this strategy requires careful timing around exam progress and market conditions to be effective.

Professional display of credentials becomes increasingly important as you advance, and knowing how to properly display certificates on your wall can enhance your professional image during client meetings and office visits, particularly valuable for consulting actuaries.

Strategic Job Change Timing Template:

- Pre-Move Phase (6 months before)

- Complete major exam or certification

- Document quantifiable achievements

- Build network connections at target companies

- Research market salary ranges

- Active Search Phase (3-4 months)

- Apply strategically to 5-8 target positions

- Leverage recruiter relationships

- Prepare for technical interviews

- Negotiate multiple offers simultaneously

- Post-Move Phase (first 90 days)

- Establish strong performance metrics

- Build internal relationships

- Identify next career milestone

- Plan 3-4 year growth trajectory

The actuary who stays at one company for their entire career typically earns significantly less than peers who move strategically. Loyalty doesn’t pay in today’s market – strategic positioning does.

Timing Your Moves for Maximum Impact

Optimal job changes occur 6-12 months after passing major exams, when your market value is highest but before the next exam cycle begins. This timing maximizes your negotiating power while minimizing career disruption.

Your exam completion creates a window of opportunity that closes relatively quickly. Employers value fresh credentials, but they also want to see you apply that knowledge in practice before the next exam cycle consumes your attention.

The Leadership Money Question: Is Management Worth It?

Actuaries who transition into management roles see dramatic salary increases (50-100% over individual contributors), but they face different risk profiles and career requirements that aren’t always financially optimal for every professional.

Management isn’t for everyone, and the financial benefits come with significant trade-offs. You’ll spend less time on technical work and more time managing people, budgets, and corporate politics. Some actuaries thrive in this environment, while others find it drains their professional satisfaction.

The Alternative Path: Senior Technical Roles

Senior technical actuaries (Chief Actuary, Principal) can earn comparable salaries to middle management while maintaining technical focus. This creates alternative career paths that many overlook in pursuit of traditional management roles.

The senior technical track offers substantial compensation without the administrative burden of management. You remain focused on complex actuarial problems while earning executive-level salaries. This path requires deep expertise and strong communication skills to influence without direct authority.

The Regulatory Appointment Double-Edged Sword

Actuaries who obtain regulatory appointments (Appointed Actuary, Signing Actuary) command significant salary premiums and job security, but these roles carry personal liability risks that require careful consideration.

Regulatory appointments come with serious responsibilities. You’re personally liable for the accuracy of regulatory filings and reserve adequacy. The compensation reflects this risk, but you need professional liability insurance and a clear understanding of your legal exposure.

Using Your Analytical Skills to Hack Your Own Compensation

Successful actuaries treat their own compensation as a data problem, using analytical skills to optimize their earning potential through market research, performance metrics, and strategic positioning that goes far beyond traditional salary negotiation tactics.

Why do actuaries accept vague performance reviews and subjective salary decisions when we’re trained to quantify everything else? I’ve found that applying actuarial thinking to your own career creates significant competitive advantages in compensation negotiations.

Treating Your Career Like a Data Science Project

Actuaries who systematically track and analyze their compensation data, market trends, and performance metrics can identify optimal timing for raises, promotions, and job changes. You’re essentially treating your career as a portfolio optimization problem.

With about 2,200 openings for actuaries projected each year over the next decade, understanding how to position yourself strategically in this growing market becomes crucial for maximizing compensation opportunities.

The actuary who approaches career management with the same rigor we apply to insurance pricing gains substantial advantages. You can identify market inefficiencies, optimal timing for moves, and quantify your value proposition in ways that resonate with employers.

Building Your Personal Salary Model

Creating personal compensation models that factor in exam progress, market conditions, and performance metrics allows actuaries to predict optimal career moves and negotiate from positions of analytical strength.

Personal Compensation Analysis Framework:

- Track monthly salary data across 5+ job sites

- Monitor exam pass rates and salary correlation

- Analyze company financial performance vs. compensation

- Document your quantifiable business impact

- Model different career path scenarios

- Calculate total compensation ROI for different moves

- Set up alerts for relevant job postings

- Maintain relationships with 3-5 recruiters

Your personal salary model should incorporate multiple data sources and update regularly. Market conditions change rapidly, and your model needs to reflect current realities rather than historical patterns.

The Numbers That Actually Matter in Performance Reviews

Actuaries who quantify their business impact through specific metrics (cost savings, revenue generation, risk reduction) can justify salary increases with concrete data, moving beyond subjective performance discussions.

Jennifer prepared for her annual review by documenting that her reserve analysis improvements saved her company $2.3 million in regulatory capital requirements. She presented this as a 15:1 ROI on her salary and successfully negotiated a 28% raise plus additional equity compensation.

Performance reviews become much more productive when you present quantifiable achievements. Instead of discussing your “strong analytical skills,” you demonstrate how those skills generated measurable business value.

Why Your Network Is Worth Real Money

Professional networks significantly impact actuarial salaries through job referrals, insider market intelligence, and mentorship opportunities. Well-connected actuaries earn 15-25% more than equally qualified peers with limited networks.

As your career progresses, maintaining professional documentation becomes essential, and understanding how to obtain academic transcripts for verification purposes ensures you’re prepared for background checks and credential verification during high-level position transitions.

Networking isn’t just about collecting business cards at conferences. Your professional relationships provide market intelligence, job opportunities, and career guidance that directly impact your earning potential. The actuary with strong industry connections learns about opportunities before they’re posted publicly.

The ROI of Professional Society Membership

Active participation in actuarial societies and professional organizations typically returns 3-5x the investment through networking opportunities, continuing education, and career advancement connections.

Professional society involvement pays dividends throughout your career. You meet potential employers, learn about industry trends, and build relationships that open doors to better opportunities. The membership fees and conference costs are minimal compared to the career benefits.

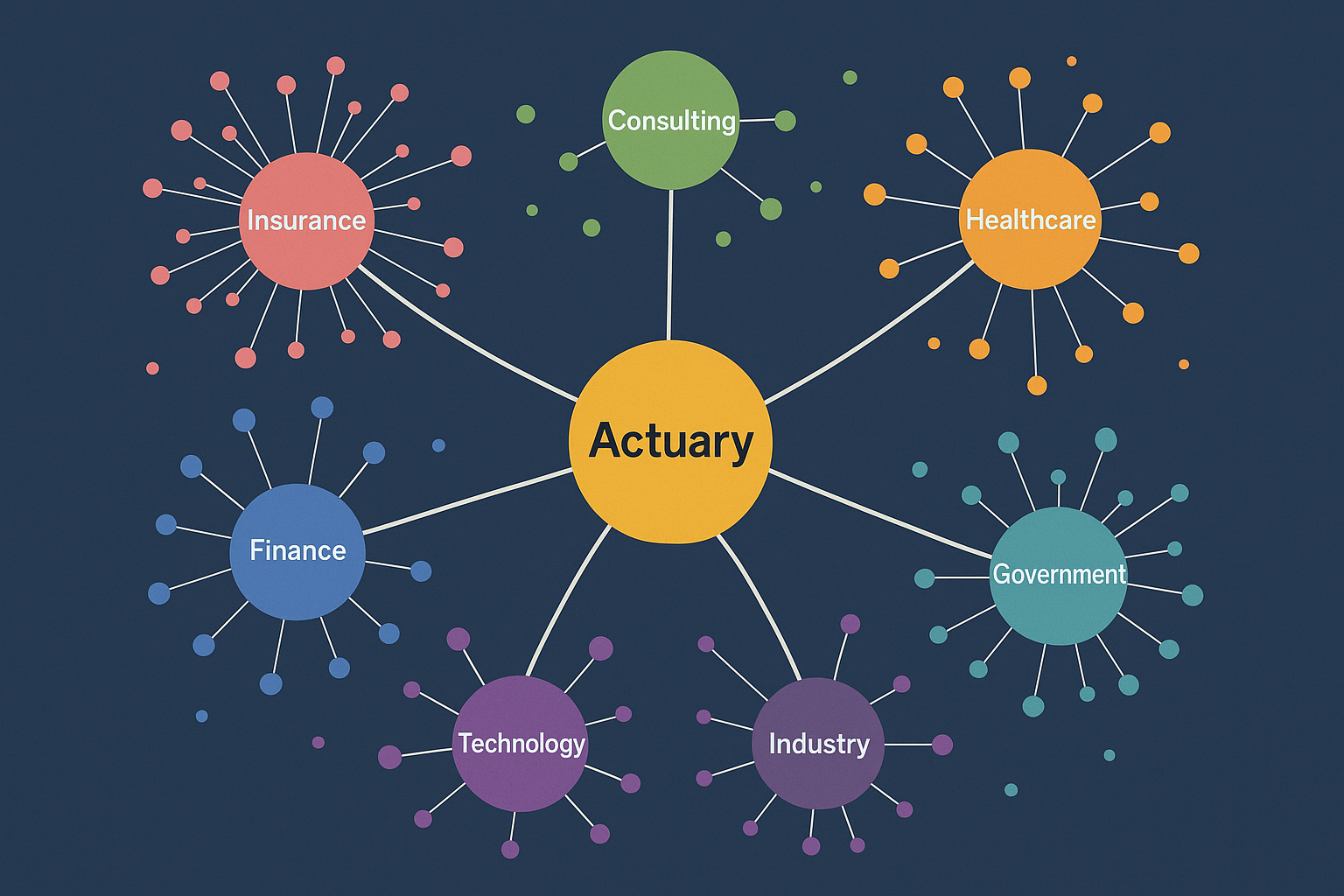

The Future of Actuarial Pay: New Opportunities Beyond Insurance

The actuarial profession is experiencing rapid evolution in compensation structures, with new roles, alternative career paths, and non-traditional employers creating opportunities that don’t fit historical salary data. This requires forward-thinking career strategies.

Traditional actuarial career paths are expanding rapidly. Insurance companies no longer monopolize actuarial talent, and new employers bring different compensation philosophies and structures. The actuaries salary landscape is becoming more diverse and potentially more lucrative.

Where the Real Money Is Moving

Technology companies, government agencies, and consulting firms are hiring actuaries for non-insurance roles, often offering higher compensation but different career trajectories that require careful evaluation against traditional insurance industry paths.

The industry-standard DW Simpson salary survey provides comprehensive data on compensation trends, showing clear patterns where total compensation (including bonuses) significantly exceeds base salary across all experience levels.

Non-traditional employers often value actuarial skills differently than insurance companies. They’re willing to pay premiums for analytical rigor and risk management expertise, even when applied to non-insurance problems. The salary for actuaries in these roles often exceeds traditional insurance positions.

The Tech Company Premium That’s Hard to Ignore

Technology companies hiring actuaries for data science, risk management, and product development roles typically offer 25-40% salary premiums over insurance companies, plus equity compensation that can significantly multiply total earnings.

The growing recognition of actuarial expertise globally is evident in recent salary surveys, where “finance and insurance professionals earn the highest average monthly salary” at NT$120,000 among managers and supervisors, demonstrating the premium placed on financial risk expertise.

Tech companies operate with different compensation philosophies than traditional insurers. They offer equity participation, aggressive salary growth, and performance bonuses that can dramatically exceed insurance industry standards. The actuary who successfully transitions to tech often sees immediate salary increases of 30-50%.

Going Independent: The High-Risk, High-Reward Path

Actuaries who develop deep expertise in emerging areas like climate risk, cyber security, or regulatory compliance can command premium consulting rates ($200-500/hour) as independent contractors or boutique firm partners.

For independent actuaries, maintaining proper documentation of all credentials becomes crucial for client trust, which is why knowing how to professionally display framed diplomas in your office can enhance credibility during client meetings and business development activities.

Independent Consulting Readiness Checklist:

- Develop 5+ years of specialized expertise

- Build client base while employed (ethically)

- Establish professional liability insurance

- Create standardized service offerings

- Develop marketing and business development skills

- Build 6-12 months of operating capital

- Understand tax implications of self-employment

- Create scalable business processes

Independent consulting offers unlimited earning potential but requires entrepreneurial skills beyond actuarial science. You become responsible for business development, client management, and operational efficiency while maintaining technical excellence.

The Entrepreneurial Actuarial Opportunity

Actuaries launching their own consulting practices or InsurTech ventures can achieve unlimited earning potential, but face significant business risks and require entrepreneurial skills beyond traditional actuarial training.

The entrepreneurial path attracts actuaries who want to build something beyond traditional employment. InsurTech startups, specialized consulting firms, and technology ventures offer opportunities to create substantial wealth while applying actuarial expertise to innovative problems. The actuary salary potential becomes unlimited, but so do the risks.

Throughout your career journey, you’ll need proper documentation of your educational achievements. ValidGrad understands that important documents like diplomas and transcripts can be lost or damaged during career transitions or relocations. For actuaries who need replacement copies of their educational credentials for display purposes or as backup documentation, ValidGrad provides professional-quality reproductions that serve as meaningful reminders of your educational achievements. This is particularly valuable when you want to display credentials in multiple locations while keeping originals secure during frequent career moves.

Final Thoughts

The actuarial salary landscape is more complex and opportunity-rich than most people realize. Success isn’t just about passing exams and waiting for promotions – it’s about understanding market forces, timing strategic moves, and leveraging your analytical skills to optimize your own compensation.

The profession is evolving rapidly, creating new high-paying opportunities for those who stay ahead of the curve. Whether you’re just starting out or looking to accelerate your existing career, treating your compensation as a data problem you can solve will give you a significant advantage over peers who take a passive approach to their earning potential.

The actuary who combines technical excellence with strategic career thinking will thrive in this evolving landscape. Your analytical skills are your greatest asset – use them to optimize not just insurance products, but your own professional success.